Small Satellite Market Report 2024: Insights, Trends, and Forecasts

The Small Satellite Market Report for 2024 offers a comprehensive analysis of the global small satellite industry, detailing crucial data on market dynamics, growth drivers, challenges, and future potential. This report is particularly valuable for stakeholders such as CEOs, global managers, analysts, and policymakers who are interested in the latest market trends and strategic insights that can shape the future trajectory of the small satellite industry.

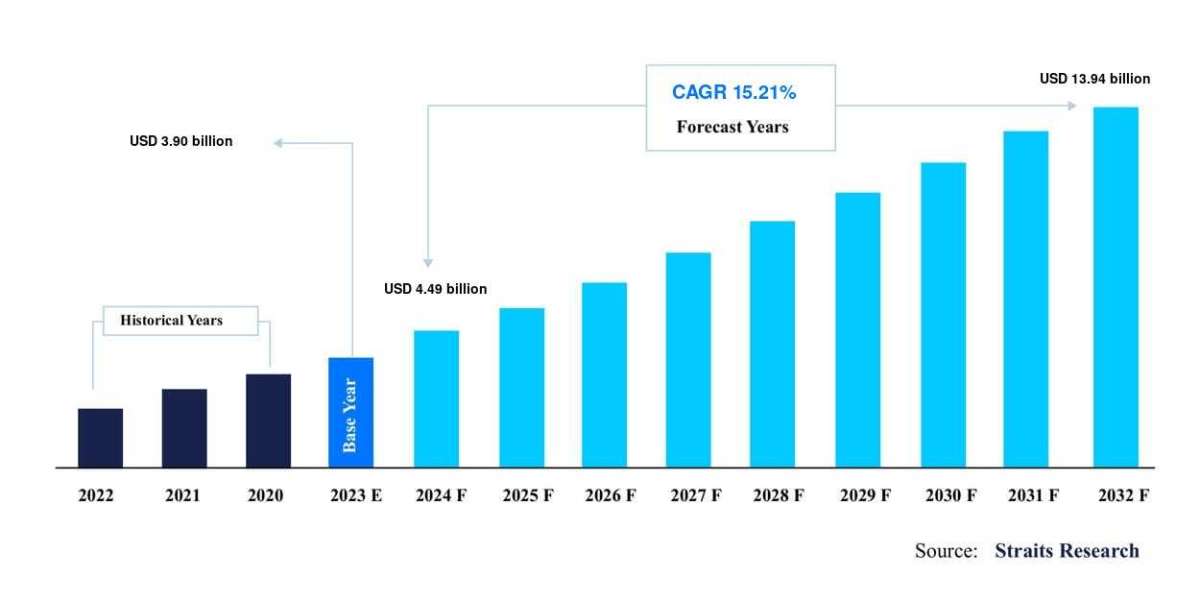

Market Overview and Growth Projections

The global small satellite market has seen remarkable growth in recent years, driven by increasing demand for satellite-based communication, earth observation, and navigation services. According to Straits Research, the market size was valued at USD XX Billion in 2023 and is projected to grow from USD XX Billion in 2024 to USD XX Billion by 2032, with a CAGR of XYZ% during the forecast period (2024–2032).

Get a Sample PDF/Excel of the report starting from USD 995: https://straitsresearch.com/report/small-satellite-market/request-sample

Key Players in the Small Satellite Market

- SpaceX

- OneWeb

- Planet Labs

- Lockheed Martin

- Northrop Grumman

- L3Harris Technology

- The Boeing Company

- Airbus Defence and Space

These companies are leading the small satellite market, focusing on innovations in nanosatellites, microsatellites, and minisatellites for a wide range of commercial and defense applications.

Small Satellite Segmentation by Weight

The small satellite market can be segmented by satellite weight into:

- Nanosatellites: Weighing between 1 and 10 kilograms, these are often used for research and low-cost missions.

- Microsatellites: Weighing between 10 and 100 kilograms, ideal for commercial and scientific applications.

- Minisatellites: Weighing between 100 and 500 kilograms, often used in earth observation and telecommunications.

- Picosatellites: Weighing less than 1 kilogram, primarily used for educational purposes or specific short-duration missions.

Orbital Segmentations: LEO, GEO, MEO

Small satellites operate in different orbits depending on their mission requirements:

- Low Earth Orbit (LEO): Ideal for communication and earth observation applications.

- Geostationary Earth Orbit (GEO): Used primarily for weather monitoring and large-scale communication systems.

- Medium Earth Orbit (MEO): Often used for navigation satellites, such as GPS systems.

- Other Orbits: These include orbits that support specific missions, like polar or sun-synchronous orbits.

Applications of Small Satellites

Small satellites are essential in a variety of applications, including:

- Communication: Enabling global broadband coverage, satellite internet, and rural connectivity solutions.

- Navigation: Used in GNSS (Global Navigation Satellite System) applications like GPS, GLONASS, and Galileo systems.

- Earth Observation: Monitoring weather, natural disasters, and environmental changes.

- Other Applications: These include scientific research, military reconnaissance, and technology demonstration.

End-User Segmentation

The report segments the market by end-user, focusing on the following sectors:

- Commercial: Private companies driving demand for telecommunication, broadcasting, and earth observation services.

- Government and Defense: Government agencies and defense organizations using small satellites for national security, navigation, and earth observation.

- Others: Educational institutions and research organizations deploying small satellites for research and exploration.

Regional Insights and Analysis

The regional analysis of the small satellite market provides insights into key geographic regions:

- North America: Dominating the market due to high investments in space technology and the presence of leading companies such as SpaceX and Lockheed Martin.

- Europe: Increasing interest in space exploration and communication services, supported by ESA (European Space Agency) initiatives.

- Asia-Pacific (APAC): Rapidly growing due to rising demand for telecommunications and advancements in space research by countries like China, India, and Japan.

- Middle East and Africa: Governments in the region are investing in space programs for military, communication, and scientific research.

- Latin America: Emerging market driven by the need for rural connectivity and earth observation for environmental monitoring.

Key Market Trends and Drivers

- Rise of Private Sector Participation: Private companies, especially those offering low-cost launch solutions, are driving the market's growth.

- Increasing Demand for Satellite-Based Communication: Small satellites are ideal for providing global broadband coverage, especially in remote areas.

- Technological Advancements: Miniaturization of technology has made small satellites more affordable and efficient, increasing their adoption across various industries.

Impact of COVID-19 and Geopolitical Factors

The report highlights the impact of COVID-19 on the small satellite market, including disruptions in the global supply chain and delays in satellite launches. Geopolitical tensions, such as Russia-Ukraine conflict, have also influenced the defense sector's increased demand for earth observation and communication satellites.

Unit Economics: Key Metrics for Industry Leaders

For business leaders, understanding key financial metrics is crucial for strategic decision-making:

- Cost of Goods Sold (COGS): Includes the cost of materials, labor, and satellite launch expenses.

- RD Costs: Significant investments in technology innovation and compliance with industry standards.

- Gross Margin: A critical metric indicating the profitability of satellite projects.

- Customer Acquisition Costs (CAC): Essential for securing government contracts and commercial deals.

- Capital Expenditure (CapEx): Investment in infrastructure, satellite manufacturing, and research facilities.

Why This Report is Essential for Strategic Planning

This report provides critical insights into the current and future trends of the small satellite market, offering decision-makers actionable data to enhance their strategic planning processes. The in-depth market analysis offers a roadmap for investments, product development, and partnerships in the global space industry.

COVID-19 Aftermath and Geopolitical Influences

The report also explores the long-term impacts of COVID-19 on satellite manufacturing and launching processes, as well as how geopolitical tensions like the Russia-Ukraine war are reshaping the defense and space sectors.

This report is available for purchase at: https://straitsresearch.com/buy-now/small-satellite-market

About Us

Straits Research is a leading research and intelligence organization specializing in market analytics, providing businesses with high-quality research reports and insights.

For further inquiries, contact us:

- Email: sales@straitsresearch.com

- Phone: +1 646 905 0080 (U.S.), +91 8087085354 (India), +44 203 695 0072 (U.K.)

- Address: 825 3rd Avenue, New York, NY, USA, 10022